All About Arbitrum

Arbitrum, an optimistic rollup on Ethereum, recently grabbed a lot of attention for its token airdrop. But there is more to it than just the token.

Index

Introduction

Arbitrum, a Layer-2 scaling solution on Ethereum, launched its token $ARB on the 23rd of this month.

Looking at Twitter, it would not be wrong to say that the community has been looking forward to this for a long time and was pumped when the date was announced.

The Layer-2 space has been heating up for some time, and it is only getting hotter with announcements from zkSync and Polygon coming out later.

Those familiar with the Ethereum space know that the vision of this biggest public blockchain is centred around rollups.

Vitalik Buterin was the first to formalize this idea, and ever since the Ethereum roadmap has been modified to incorporate this vision, the community has rallied behind this idea.

But what is Arbitrum, and why is it so sought after?

In this article, we will look at the basics of this project, understand its tokenomics and performance, and look into its future.

What is Arbitrum?

As we know, scaling solutions are meant to address the scalability concerns of Ethereum. Arbitrum is a Layer-2 rollup scaling solution that runs on top of Ethereum and belongs to a type of roll-up called “Optimistic” rollups.

Let’s understand this further by first looking at what happens on Ethereum.

Two essential things happen when a transaction is posted on Ethereum. First, it is included, and Ethereum agrees (a.k.a consensus) on the ordered transactions. Second, Ethereum processes the transactions and computes the state change that results.

Having every Ethereum node perform every transaction is costly, and rollups are a scaling solution that dramatically reduces this load as transactions are not executed on Ethereum but on Layer 2 ("L2").

But this presents a problem. If a transaction is not executed on Ethereum, how can it reach a consensus?

The answer lies in something called “proofs.”

Rollups demonstrate their correctness to Ethereum by using these mathematical proofs that allow Ethereum to validate correctness.

This proof is called "fraud-proof" for an optimistic rollup like Arbitrum (and Optimism).

But why call it an Optimistic rollup?

The answer lies in the mechanism which controls when these fraud proofs are generated. Yes, these proofs are not produced for every rolled-up transaction batch, but only when a transaction is challenged by one of the network nodes.

In other words, the default state of optimistic rollups is to assume that all transactions are correctly executed, which are then rolled up and sent to Ethereum. Hence the name.

But isn’t this dangerous? There is no check on the validity of transactions, so a malicious actor can easily trick the system.

Optimistic rollups address this concern by incentivizing the players within the network to act straight.

According to Offchain Labs, the company that created Arbitrum:

The parties have strong incentives to post only correct claims, and to challenge incorrect claims, so in the common case all nodes simply execute all of the transactions and the proof code never needs to be invoked.

Arbitrum One and Nova

The original Arbitrum scaling solution is called “One” and is the leading Arbitrum ecosystem network.

It is a fully-functional, decentralized network offering high throughput and low transaction fees, enabling developers to build and deploy decentralized applications (dApps) with a better user experience.

Arbitrum One houses a large number of EVM-compatible dApps today. You can view its ecosystem here.

Arbitrum Nova is a different scaling solution made public in August of 2022.

It is designed specifically for gaming, social networks, or other applications with high transaction volume since they need even lower fees and faster speeds, which Nova achieves by reducing its security.

According to Offchain Labs:

AnyTrust Chains, which allow for much lower cost and faster withdrawals, in exchange for a minimal extra trust assumption.

which is a fancy way to say reduced security ;-) And here is a link to their portal showcasing all the various dApps using Nova.

Tokenomics

The main reason behind creating their $ARB token was to remove any centralizing aspect from the protocol and also keep the capability to upgrade it with newer technologies.

According to the newly created Arbitrum Foundation:

So we can’t give up upgradeability but we want to remove central points of control. But then who controls upgradeability? The Arbitrum DAO does, and the $ARB token is essential for distributing this power to the community. And that’s why a token is necessary for securely scaling Ethereum.

And so, the $ARB token is a Governance Token.

The entire token distribution looks like this

With a max supply of 10 billion tokens, the overall token distribution is as follows:

17.53% is allocated to Investors

1.13% is allocated to DAOs in Arbitrum Ecosystem

11.62% is allocated to Individual Wallets

42.78% is allocated to DAO Treasury

26.94% is allocated to Team and Future Team + Advisors

Out of this, 12.75% of tokens for users and DAOs in the ecosystem have already been airdropped on the 23rd of March.

Performance

In this section, we will look at how Arbitrum has performed since its inception using some basic metrics.

Usage:

Usage is probably the simplest and the most powerful metric. Usage means how much a project is used by end users, developers, and other applications.

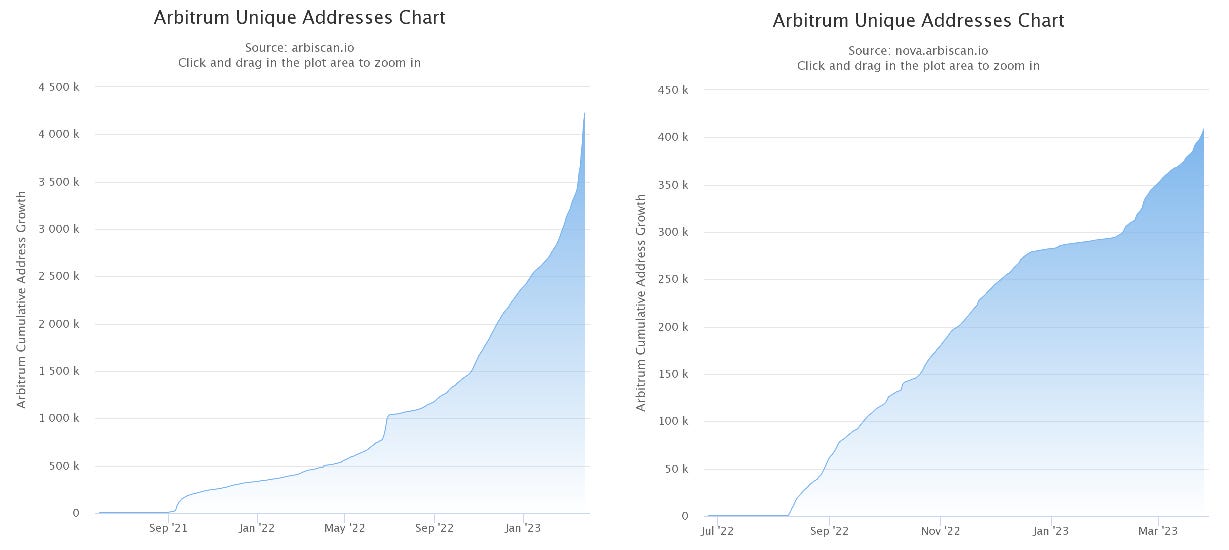

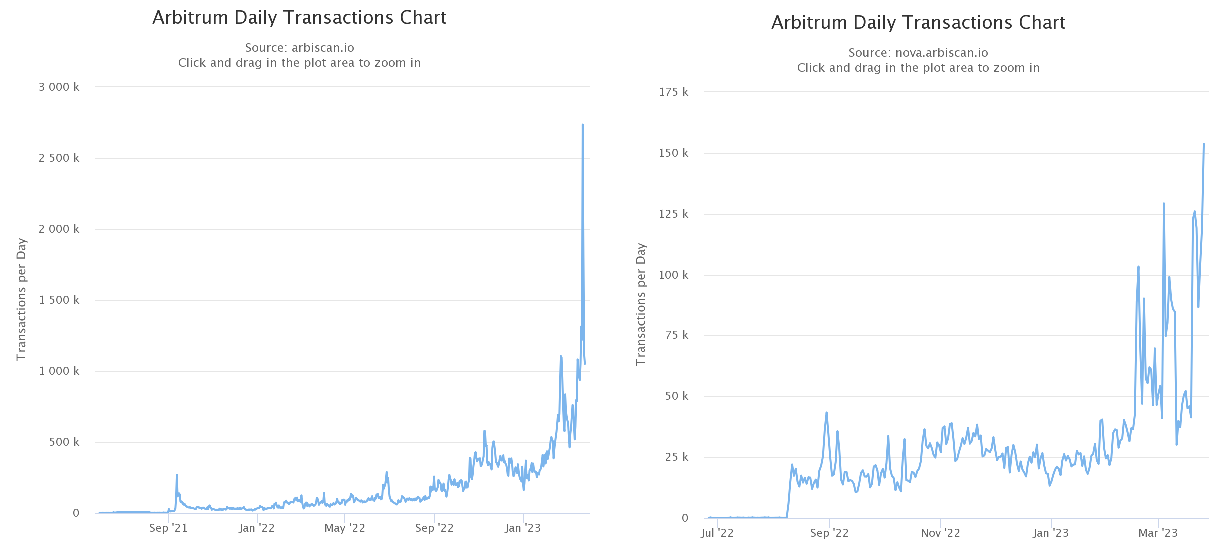

Data from both Arbitrum One and Arbitrum Nova block explorer show an impressive rise in the number of unique addresses on the networks.

Daily transaction data for both solutions also show a consistent rise over time.

TVL:

Total Value Locked (TVL) refers to the total value of assets (tokens and stablecoins) currently being held in a particular decentralized finance (DeFi) protocol. TVL is an important metric to measure the growth and adoption of DeFi protocols.

A higher TVL indicates greater interest and participation in a particular DeFi protocol. This can translate into increased liquidity, improved functionality, and more user opportunities to earn rewards or generate profits.

According to Defillama, Arbitrum is already the fourth largest chain by TVL.

And the trend shows a steady increase after a period of decline and sideways movement.

Important to know here is that the $ARB token associated with Arbitrum One constitutes almost 26% of the TVL.

Developer activity:

Developer activity is a very important metric that shows how well a project attracts and retains talent.

A lot of parameters go into this one measurement. So if a project shows a consistent rise or maintains a consistent level of developer activity, it is usually considered a good thing.

Pulling developer activity data from Santiment shows that Arbitrum has steadily risen in this department.

Transactions per second:

And finally, if we are talking about scaling Ethereum, there should be a way to measure how well these solutions do their job.

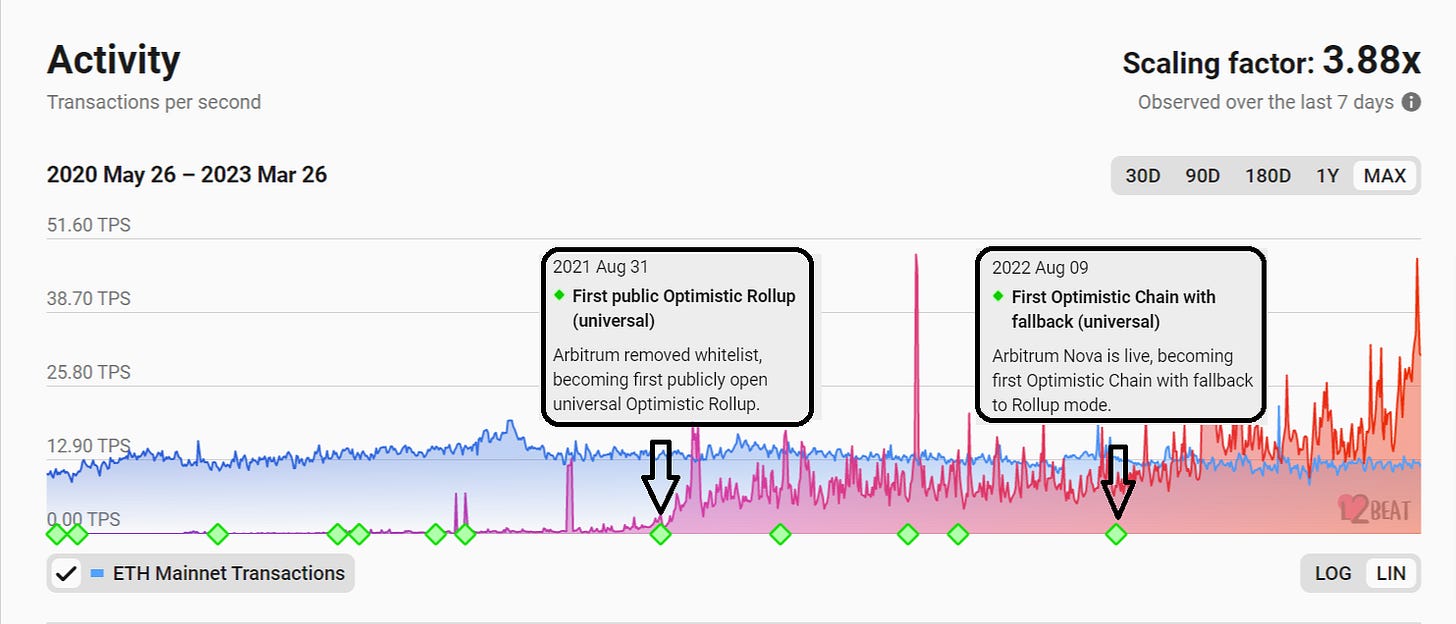

Enter L2beat.com.

This wonderful website is probably the most impressive resource on Layer 2 scaling solutions and their impact on Ethereum.

From L2beat, we see that ALL scaling solutions have had a massive impact on Ethereum in terms of offloading transaction execution to them.

The scaling factor in the top right corner indicates how many MORE transactions have been settled by Ethereum because of all the L2 solutions now.

Within this cohort of L2 solutions, Arbitrum is currently at the top, with the most transactions executed so far.

To wrap it up, Arbitrum enjoys a growing user base, transaction count, developer activity, and value locked.

Arbitrum Foundation and Orbit

The recent development was more than just a mere airdrop.

It was the beginning of the Arbitrum Foundation DAO, which now has complete control over all Arbitrum Layer-2s.

The DAO is termed a “self-executing” DAO, meaning that smart contracts are used to execute decisions the members make automatically.

According to Arbitrum Foundation:

Arbitrum’s DAO governance is self-executing, meaning that the DAO’s votes about on-chain actions will directly have the power to effect and execute its on-chain decisions, without relying on an intermediary to carry out those decisions.

A security council has also been established for critical changes that need to be pushed quickly and, in some situations, without sharing the details with the foundation DAO members.

The Arbitrum Foundation also established the Arbitrum Security Council, a 12-member multisig of highly regarded community representatives designed to ensure the security of the chains and be able to act quickly in the event of a security vulnerability. In case of emergency, the Arbitrum Security Council will be able to act swiftly, but this will require participation from 9 of the 12 members.

However, with biannual elections, the DAO will control who is and is not part of this security council. The DAO can also dissolve the security council if it needs to do so.

Another major announcement was the launch of Arbitrum Orbit.

Orbit is a technology that lets developers create their layer 3 blockchains on top of either Arbitrum One or Nova in a permissionless fashion.

Compared to this, Optimism, Arbitrum’s primary competitor, had a different growth model where developers can create their layer 2 blockchains using their technology stack.

It will be interesting to see which model works better as we advance. The folks at Bankless feel that Arbitrum has a better model since it does not allow competition to their main layer 2 chains.

Coming back to Orbit, the important point is that the DAO controls the creation of new L2, but L3s do not require permission.

Also, developers can use Arbitrum Stylus, an upcoming tool that allows developers to use C/C++ and Rust programming languages.

State of Decentralization

There has been a lot of talk about how layer 2 scaling solutions are not decentralized.

L2Beat provides a brilliant representation of the state of centralization amongst all the scaling solutions.

For Arbitrum, the biggest issue is that its validators are selected through a process instead of being permissionless.

The Arbitrum foundation has delved deeper into this issue and proposed “progressive decentralization” as the answer.

Progressive decentralization is the process of gradually increasing the level of decentralization within the Arbitrum ecosystem.

This includes four main categories:

Chain ownership:

With the latest development, Arbitrum One and Nova have decentralized ownership with a DAO and a security council. The DAO now controls what changes will be made to these chains and proposals for new L2s.

The security council can push critical changes quickly using a 9 of 12 multisig wallet but only in emergencies.

Validator ownership:

Validator nodes secure the Arbitrum chain by posting transactions to the chain's state and challenging (fraud-proofs) any fraudulent transactions made by other validators.

Since these nodes are selected and not permissionless, this has become the biggest centralizing vector for Arbitrum.

Hopefully, with the DAO now controlling the chains, we could see either more validators added or a DVT-type collaboration with ssv.network to decentralize these validators.

Sequencer ownership:

Sequencer is a system within Arbitrum responsible for collecting and ordering transactions.

The risk here is that a compromised sequencer could reject transactions or modify the order for nefarious purposes. But it can’t stop the chain; the only real threat to the rejected transactions is a time delay.

The DAO has the power to add more sequencers which will improve the distribution of these sequencers.

Data Availability Committee ownership:

AnyTrust chains like Nova require an additional committee called the DAC to get that extra bump in speed and reduction in fees.

The DAC currently has 7 members, requiring at least one honest member to function at all times.

The DAO also controls the DAC and can add more members to it.

Final Thoughts

That was a lot to cover!

Hopefully, this gives you a starting point into Arbitrum.

The ARB token launch and the Arbitrum foundation's creation could be a defining moment leading towards the multi-rollup-centric world that Ethereum has been advocating.

At the moment, Arbitrum is the undisputed leader in layer 2 scaling solutions, and it is not showing any signs of slowing down.

With the latest developments, including Orbit, it could become a force to reckon with in the L2 space.

But there is yet another side that we have not yet fully discovered: the zero-knowledge rollups.

A lot is brewing in the zk space, and it will be interesting to see how things shape up in the rollup world as we advance.